As the first wave of Donald Trump’s newly imposed 10% global tariff takes effect at Saturday, April 5th 2025, nearly every imported product from all nations—including key trade partners like China, Mexico, and the European Union—will be hit with new duties. This 10% baseline rate is just the beginning: countries singled out in Trump’s “reciprocal tariff” regime, such as China, are scheduled for steeper increases, with rates rising to 34% by April 9. While the administration frames the move as a necessary correction to unfair trade practices and a strategy to revive American manufacturing, economists and industry leaders are sounding alarms. The broader economic consequences may be swift and severe—slowing consumer spending, raising inflation, and potentially tipping the U.S. into a recession. Among the sectors most at risk is housing, where increased construction costs, higher uncertainty, and reduced buyer power could destabilize an already fragile market.

How Tariffs Could Trigger a Recession

Tariffs are, at their core, taxes on imports. When implemented, the cost of foreign goods rises. U.S. companies that rely on imported raw materials or products—particularly in construction, electronics, automotive, and retail—must either absorb the higher costs or pass them on to consumers.

According to a CNN report (April 4, 2025), economists are growing increasingly concerned that these tariffs could reduce GDP growth, push up inflation, and slow down consumer spending. This Al Jazeera article (April 5, 2025) highlighted fears of a global trade war as retaliation from China and the EU looms, increasing the likelihood of a broader economic downturn.

A recession—typically defined as two consecutive quarters of negative GDP growth—could be triggered if businesses delay investments, consumer confidence falls, and layoffs begin in tariff-sensitive industries. And when the economy slows, the housing market rarely escapes unscathed.

The Direct Impact on the U.S. Housing Market

The housing sector is uniquely sensitive to macroeconomic pressures. Here’s how Trump’s tariffs—and a potential recession—could affect it:

1. Rising Construction Costs

According to Cotality.com, tariffs on imported steel, aluminum, lumber, and construction-related machinery are already inflating the cost of building new homes. Builders may face up to $20,000 more in materials cost per home, costs that will either be passed on to buyers or absorbed by already tight profit margins.

This disproportionately affects entry-level and affordable housing, where profit margins are slim. Fewer affordable homes could deepen the housing shortage already plaguing many urban and suburban areas.

2. Higher Mortgage Rates? Maybe.

Initially, recessions lead to lower interest rates as the Federal Reserve tries to stimulate borrowing and investment. However, if inflation spikes due to tariffs, the Fed could be forced to keep rates elevated—or even raise them—despite weakening growth. That would hit mortgage affordability directly.

According to Economic Times, lenders are already pricing in economic uncertainty, and while short-term mortgage rates may dip, long-term volatility could make financing unpredictable, especially for first-time buyers.

3. Decline in Home Values

In a recession, demand drops faster than supply adjusts. If buyers exit the market due to job insecurity, higher prices, or tighter credit, home prices can stagnate or decline. This would be especially damaging in high-value markets like San Francisco, New York, and Miami, where even small fluctuations translate to tens of thousands in perceived equity loss.

But it won’t hit all areas equally.

Will Property Values Impact How Homes Are Affected?

Yes—significantly.

Luxury and High-End Markets

These markets are often the first to be affected in a downturn. High-value properties see fewer buyers even in good times. In recessionary environments, they may sit on the market longer and experience deeper price cuts.

Mid-Range Suburban Homes

These homes may remain somewhat resilient, especially in family-friendly areas with stable job markets. However, if recession fears hit consumer sentiment, even this tier may see decreased bidding activity and slower turnover.

Affordable Housing

Ironically, this segment faces a supply problem more than a demand issue. With tariffs driving up building costs, developers may pull back, worsening inventory shortages. Demand will stay strong, but prices may continue to climb, worsening affordability for lower-income families.

“Tariffs on imported materials like lumber and steel could raise costs for new construction, especially affecting affordable housing developments, where profit margins are slimmer.” — Cotality.com

Impact on Buyers and Sellers

Homebuyers

1. Less Buying Power

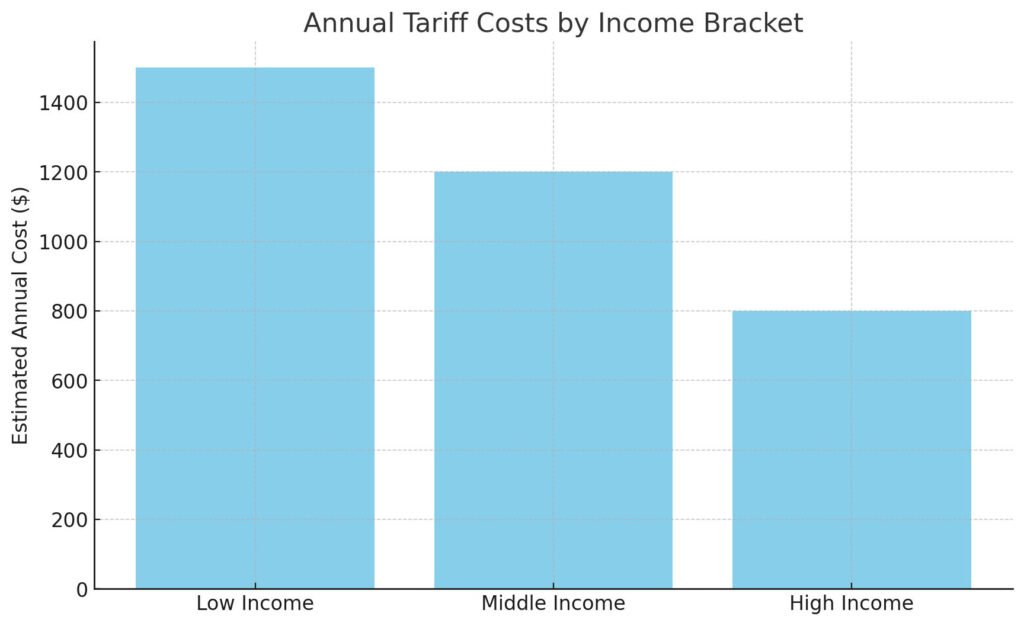

Tariffs inflate prices across the board—from groceries to home goods—which reduces disposable income. According to NBC News, lower-income households will be disproportionately affected, spending more of their paycheck on basic goods.

2. Delayed Decisions

Economic uncertainty makes buyers cautious. Many may delay large purchases like homes until the outlook improves.

3. Tighter Lending Standards

If banks grow skittish due to recession risks, getting approved for a mortgage could become more difficult, especially for first-time or lower-credit borrowers.

Home Sellers

1. Longer Time on Market

With fewer qualified buyers, homes may linger unsold for longer periods.

2. Price Adjustments

Sellers may be forced to drop asking prices or offer incentives (e.g., paying closing costs) to attract interest.

3. Investor Hesitation

Real estate investors—especially those in short-term rentals or flips—may retreat, fearing lower returns amid market instability.

Other Ways American Households Will Be Affected

Aside from housing, the broader financial pressure from tariffs will squeeze households in several ways:

Increased Cost of Goods:

An USA Today analysis estimates the average American household could pay $1,200 to $1,500 more annually due to tariff-driven inflation on common imports.

Job Security Concerns:

Tariff-affected industries (e.g., manufacturing, agriculture, retail) may respond with layoffs or hiring freezes.

Investment Losses:

Stock market volatility may erode retirement accounts and home equity lines of credit tied to asset valuations.

Lower Consumer Confidence:

Even for households not directly affected, the psychological impact of economic instability can lead to reduced spending, creating a self-reinforcing downturn.

Conclusion: A Ticking Time Bomb for Housing?

While tariffs are often pitched as protective measures, their unintended consequences are becoming increasingly clear. The housing market—already contending with affordability crises, high interest rates, and tight inventory—could be knocked off balance by rising construction costs and eroding consumer confidence.

Whether or not the U.S. enters a full-blown recession remains to be seen. But for homebuyers and sellers alike, the writing is on the wall: uncertainty is here, and the housing market may not be immune.

Smart Moves? Buyers should be cautious but prepared, while sellers may want to list sooner rather than later—before volatility takes hold.