After a couple of decades of soaring prices and increasing demand of Dubai real estate, the hot topic the recent years has been rising concerns about the sustainability of its growth. Is the Arabian hot spot for financial investments and luxury markets about to experience a coming housing bubble? We will delve and have a closer look into the factors driving the Dubai property market, examine the risks of a potential housing bubble and explore the outlook of the Emirate’s future real estate sector.

Past Boom and Bust: Understanding the Dubai Real Estate Market & Lessons from Its History

First, we must understand Dubai’s current real estate market and its dynamic drivers.

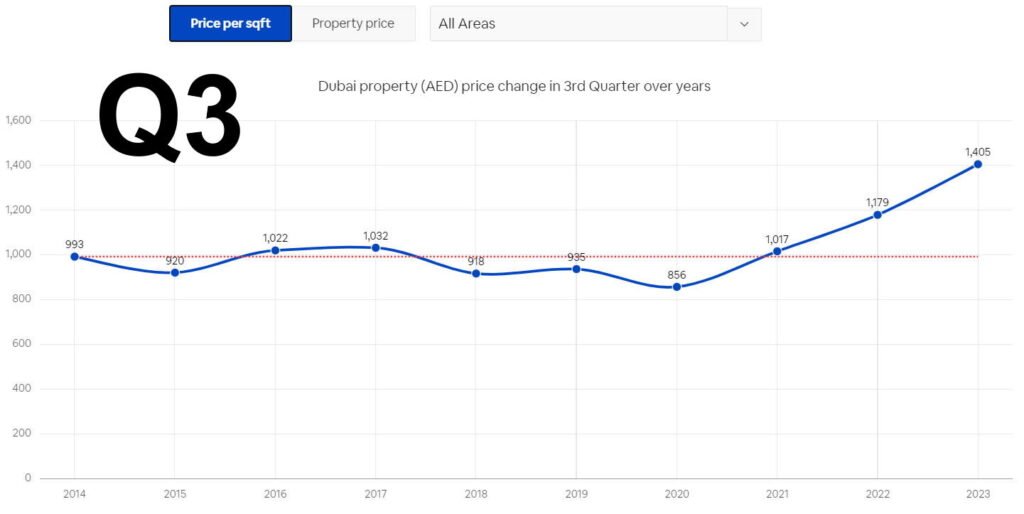

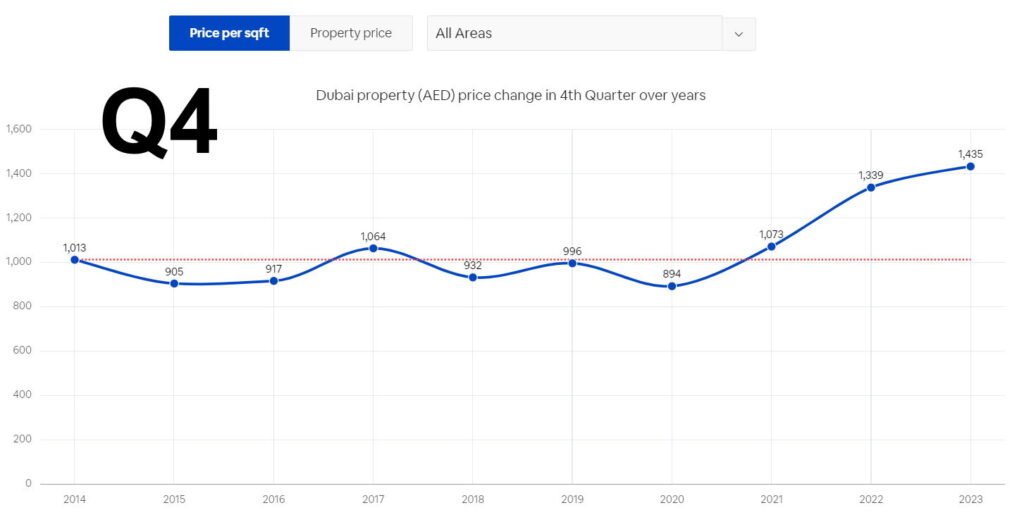

The property market has experienced significant growth in recent years, with a surge both in number of property transactions and prices. Limited taxation, favorable economic business climate that attracts foreign investors and rising population—With a huge immigrant wave of wealthy Russians as a result of the 2022 Russian full-scale invasion of Ukraine, avoiding eventual military drafts and sanctions—Have all helped driven the average residential unit prices steadily up, with a growth rate of 17% in first 9 months of 2023. According to DXB Interact, residential properties average price per square feet increased 19.2% YoY between Q3 2022 – Q3 2023. This rapid growth has raised concerns among financial experts about the possibility of a housing bubble.

The rapidly growing population is also increasing the demand of rental properties, further driving up property prices. However, it’s crucial to assess whether these price increases are sustainable or indicative of a potential housing bubble.

To understand the potential risks of a housing bubble in Dubai, it’s important to look back at the city’s modern history. Dubai experienced a housing market crash in 2008/2009 during the Financial Crisis of 2008, making property prices to fall an incredible 40% in the first three months of 2009; outpacing the impact anywhere else in the world. This sudden decline in property prices in a such heavily invested area led to a chain reaction, as many investors who had purchased property in Dubai using loans were unable to repay their debts, leading to defaults and foreclosures.

Dubai also experienced a housing market downturn in 2015 due to subdued demand, heavily inflated prices and slower economic activity.

The Emirate’s government has since then tried to implement various measures trying to prevent recurrence.

Measures to Prevent a New Housing Bubble

The UAE government has taken several measures the recent years to prevent similar crashes in it’s residential property market to reoccur. These measures include raising the fee for transferring ownership rights, imposing limitations on mortgage sizes and holding developers accountable for construction delays. The aim of these regulations are to promote responsible investments and discourage speculative behavior in its real estate sector.

The Future of the Dubai Real Estate Market

Although the Dubai property market is experiencing rapid growth, it has raised concerns among financial analytics the past years about a potential housing bubble. However, these analyzes and forecasts are quite split.

According to the UBS Global Real Estate Bubble Index of 2023, Dubai ranked low in terms of bubble risk with a ‘fair-valued’ score of 0.14—Whereas a score of 0.5 or greater is assessed as Overvalued, while 1.5+ Bubble Risk. Indicating that the market is not overvalued as its reputation as a geopolitical safe-haven has recently triggered a surge in demand for both renting and buying.

The various measures implemented by the UAE government such as stricter regulations and greater transparency of their housing market in the aftermath of the 2008/2009 Financial Crisis and the housing crash of 2015, could have contributed to a more stable market. However, vigilance is necessary to monitor any signs of overheating or speculative behavior.

Looking ahead at 2024 and the coming years, the Dubai property market is expected to continue its growth trajectory. Although it is projected to grow at a slower phase due to less global purchasing power—+5% to +7% in 2024—The demand for real estate will remain strong. The increasing population and government initiatives to attract wealthy residents & investors, will continue to be an important driver for its housing market in the years ahead. However, the long-term stability of Dubai’s housing market relies on its government and private developers maintaining a balance between supply & demand, and implementing effective regulations.

Future Sustainable Development, Infrastructure & Expansion of New Communities

With Dubai’s rapid phase of urban development and increasing population, it’s crucial for the Emirati to focus on sustainable development and infrastructure. Its transportation system needs to prioritize efficient and well-connected options to accommodate its growing population, preventing it becoming another over-congested metropolis. Sustainable city planning & development will be a crucial factor for Dubai to continue its aim to become a top global financial center.

As popular areas of investment in Dubai reach their peak in terms of development, new communities are emerging in the city outskirts. These new areas offer investors attractive pre-selling prices as prices increase notably along the overall surrounding development of the area through the years, allowing buyers to take advantage of attractive prices before they become more expensive. Developments such as Dubai Hills, Jumeirah Village Circle, and Dubai Creek Harbour are examples of such areas.

As the population continues to grow, its market is expected to evolve in response to changing needs and demand. One notable, expected shift is the increased demand for smaller housing options for expats and retirees. This is a foreseen trend and a slight shift in the property market, with more and more individuals choosing to settle in Dubai for extended periods. The development of “silver economy” communities and the need for infrastructure that meets the requirements of different life stages are likely to shape the future of Dubai’s property market, as the government put more and more effort in attracting 50+ year olds to stay in the country. This to attract more valuable skills and spending power to the nation—which otherwise would go elsewhere.

The Transition from Tenants to Homeowners: Renters Are Becoming Buyers

As property prices has grown significantly the past years, rental prices are soaring even more; forcing more and more residents to buy a home instead of renting. On an year-on-year basis between January 2023 – January 2024, rental prices for residential homes in Dubai grew about 25% depending on area. Another reason renters are becoming home buyers is that mortgage prices are now in line—sometimes often cheaper—than the monthly cost of renting a home in Dubai. That makes it a nobrainer for residents who has lived there for several years and finally want to settle down.

“We’ve seen a number of Dubai residents move from renting a property to purchasing their first home across the city,” – Charlie Bannan, sales director for real estate agency, haus & haus.

He also commented: “The catalyst for a large proportion of residents debating renting versus buying is due to the monthly mortgage payments now being either comparable, or often less on the purchasing side”.

Residential Home Rental Price Trends & Indices in UAE as of January 19’th, 2024

What Should We Expect?

While the Dubai property market has experienced significant growth in recent years, and there has been a lot of predictions about an eventual housing bubble—by studying the history of previous inflations & bursts—there are no urgent indications that Dubai even is experiencing a bubble currently according to various analysis & research firms that rates the market fair-valued. The measures implemented by the UAE government and the market’s current favorable investment climate, contributes to its stability.

The future of the Dubai’s real estate market depends on maintaining a good balance between supply and demand, implementing effective regulations and promoting sustainable developments throughout the country. As the market continues to evolve in the years ahead; new communities, infrastructure, and housing options will shape the future of Dubai’s property sector.

What is your thought?