Thailand has been a magnetic draw for globetrotting entrepreneurs, retirees, and the ever increasing influx of digital nomads for decades. Its mix of warm climate, world-class hospitality, maturing infrastructure, and competitive living costs makes it one of Asia’s most liveable destinations. In 2025, the landscape is even more attractive: new long-stay visas, improving transport links, and a buyer’s market in some condominium segments have created a compelling moment to explore how to buy property in Thailand as a foreigner—and how to live here well.

Below, we unpack the why (lifestyle and macro drivers), the how (ownership rules, “loopholes,” and practical steps), and the what next (market trends and future outlook). Throughout, we weave in further reading from Premier Possible’s Insights—on digital nomads, golden visas, Bangkok’s condo cycle, and Asia’s top cities—to help you connect the dots and plan with confidence.

Why Thailand? Lifestyle, Value, and Connectivity

For many expatriates, Thailand balances quality of life and cost efficiency like few other hubs. Beyond the postcard beaches and Michelin-listed street food, you’ll find increasingly sophisticated healthcare, international schools, and a huge choice of lifestyle neighborhoods—from Bangkok’s riverfront to Chiang Mai’s creative enclaves and Phuket’s coastal villas. Guides for would-be movers consistently highlight these draws: a friendly culture, strong expat networks, modern amenities, and ample outdoor life.

Cost of living remains competitive relative to Singapore, Hong Kong, Tokyo, or Dubai, while air connectivity across Asia makes Thailand a practical base for regional business travel. The country’s “work from anywhere” appeal also overlaps with the rise of High-Net-Worth Individuals (HNWIs) and remote professionals who design location-flexible lives—an arc explored in Premier Possible’s features on luxury digital nomads and the “Golden Visa” effect across global property markets.

Ways to Live Long-Term: From Tourist to Permanent

Thailand offers several pathways—short-stay to multi-year residency-style solutions. The right choice depends on your profile (entrepreneur, remote worker, retiree, or investor) and your intended presence (seasonal vs. year-round).

1) Long-Term Resident (LTR) Visa

Launched in 2022 and liberalized in 2025, the LTR targets “high-potential” foreigners—wealthy global citizens, wealthy pensioners, work-from-Thailand professionals, and highly-skilled professionals. Recent updates eased income and experience rules for certain categories to attract more talent and their families. Benefits include 10-year validity (in 5+5 format), fast-track services, and favorable work authorization for eligible applicants.

2) Destination Thailand Visa (DTV)

Introduced in 2024, the DTV caters to remote workers, freelancers, and creative visitors seeking long stints. It’s a five-year, multiple-entry visa allowing stays up to 180 days per entry (extendable once per entry). Financial proofs apply. Think of it as a flexible bridge between tourism and residency for the “workcation” crowd.

3) Retirement, Marriage, and Business Routes

Classic retirement extensions (age 50+) and marriage-based extensions remain popular, while business setups and BOI-sponsored roles support those growing companies in Thailand. Details and eligibility vary by route and should be confirmed with current consular guidance.

4) Permanent Residence (PR)

Thailand’s PR program is selective, historically with an annual quota of up to 100 people per nationality and criteria spanning investment, employment, expertise, or family ties. Expect stringent documentation, multi-year presence in Thailand, and language/civic integration steps. PR does not expire (though re-entry permissions do); it can set the stage for future citizenship applications after a qualifying period.

Where Expats Settle: Urban Culture, Beach Life, or Mountain Cool

Bangkok anchors finance, creative industries, healthcare, and international education, with neighborhoods ranging from riverside cultural quarters to high-rise CBDs like Sathorn–Silom and Asok–Phrom Phong. Chiang Mai appeals to creatives and slower-living remote workers, while Phuket and Koh Samui skew to beach-focused lifestyles (and villa markets), and Pattaya blends resort living with proximity to U-Tapao airport and the Eastern Economic Corridor. Mainstream expat guides across lifestyle sites consistently spotlight these hubs for infrastructure and community.

Premier Possible’s review of Time Out’s top Asian cities adds cultural color to why Bangkok and its peers keep topping global livability lists.

What Foreigners Can (and Can’t) Own in Thailand

Headline rule: Foreigners cannot own land in their personal name in Thailand. But there are clear, legal workarounds—and one very clean exception.

Freehold condominiums (the clean exception)

Under the Condominium Act, foreigners may hold freehold title to condo units, subject to the 49% foreign-ownership quota of the building’s total saleable area. To register title, purchase funds usually must be remitted from overseas and evidenced by a Foreign Exchange Transaction (FET) form issued by a Thai bank—an essential step at the Land Office.

Houses and villas (structure vs. land)

A foreigner can own a building (the villa/house) separate from the land, typically pairing house ownership with a long land lease (see below) or a right such as superficies. Transfers of house-only ownership and building permits are handled at the Land Office.

Leases and real rights

The go-to method to control land use is a registered lease (up to 30 years), often with contractual renewal options and sometimes layered with superficies (right to own the building on another’s land) or usufruct (use/benefit rights). Renewal promises in leases are personal obligations—they should be drafted carefully and registered to maximize enforceability.

Thai companies and “nominees”

Some try to buy land via Thai-majority companies. While genuine businesses can own land under specific conditions (including BOI privileges), using “nominee” shareholders to evade foreign ownership limits is illegal. Work with reputable counsel if you are exploring corporate routes.

Leasehold as a strategic alternative

Well-structured leaseholds—properly registered with the Land Department—offer long-term security for high-end villas or landed homes, especially in resort markets. Expect registration fees and, for leases, calculation based on the total lease value.

Renting and Leasing: Smooth, Flexible, and Common

Many foreigners start with renting before buying. Reputable brokers outline standard steps: define budget and location, review inventories, verify landlord documents, and register a lease (particularly for multi-year arrangements). Shorter-term rentals are typically handled via private contracts; longer terms benefit from Land Office registration for legal strength. Expect lease registration fees and stamp duty on lease contracts.

Step-by-Step: How to Buy a Thai Condo as a Foreigner

1. Pre-screen the building’s foreign quota

Your lawyer or the building juristic person confirms foreign ownership availability (≤ 49%).

2. Conduct due diligence

Title deed check, encumbrances, building permits, developer reputation, and co-owner obligations (common fees, sinking fund).

3. Pay and document properly

Wire purchase funds from abroad; your receiving Thai bank issues the FET form naming you as sender/recipient, specifying the purpose (condo purchase).

4. Sign a robust Sales & Purchase Agreement (SPA)

Clarify fixtures, handover condition, defect liability, and who pays which transfer taxes and fees.

5. Transfer at the Land Office

Bring passport, FET form, executed SPA, and required developer/condo juristic letters. Title is updated on the Chanote (condo title deed)

6. Post-transfer housekeeping

Connect utilities, enroll with the building juristic, arrange insurance, and update address records if needed.

(For financing, options do exist—though stricter—via select banks or overseas financing against assets; cash buyers remain common.)

Taxes and Transaction Costs on Thai Property Purchases: What to Budget

At transfer, buyers and sellers in Thailand typically allocate costs by contractual agreement. The common items include:

- Transfer fee: 2% of the registered/appraised value (often shared).

- Specific Business Tax (SBT): 3.3% if the seller has held for <5 years (developer sales commonly incur this).

- Stamp duty: 0.5% (applies when SBT does not).

- Withholding tax: 1% for corporate sellers; progressive for individuals. (Source: Siam Legal)

Annual holding costs fall under the Land & Building Tax regime, with residential rates broadly 0.02%–0.10% (primary homes) and higher brackets for non-primary residential or commercial use. Vacant/under-utilized land can attract escalating rates over time to discourage speculation.

Rental income is taxable in Thailand, and foreign owners should coordinate cross-border tax filings. The interaction of Thai tax residency and foreign-sourced income remittance rules has evolved; consult a qualified adviser on post-2024 guidance for Thai tax residents with global income. Big-Four updates and specialist advisories provide current interpretations and relief measures.

Work, Business Climate, and BOI Nuance — Plus: What Taxes Expats Pay

Thailand’s appeal to founders and professionals is more than lifestyle. The country blends a diversifying economy (manufacturing, logistics, healthcare, tourism) with targeted incentives—from the Board of Investment (BOI) to long-stay visas (LTR/DTV)—that make it easier to base regional activity here. Structuring still matters: the Foreign Business Act restricts certain sectors, and BOI privileges are specific to promoted activities (and are distinct from personal ownership rights). For corporate or Thai-majority structures, work with counsel to ensure genuine substance and compliance.

Now, the part everyone asks about: taxes—on income and wealth—for expats.

Who is a Thai tax resident?

You’re generally treated as tax resident if you spend ≥180 days in Thailand in a calendar year. Residents are taxed on Thai-source income, and—since the 2024 rule change—on foreign-sourced income once it’s remitted to Thailand (see the remittance timing nuances below). Non-residents pay Thai tax only on Thai-source income.

Personal income tax (PIT) rates

Thailand applies progressive PIT bands from 0% up to 35%, with current brackets widely cited at THB 0–150,000 (0%), 150,001–300,000 (5%), 300,001–500,000 (10%), 500,001–750,000 (15%), 750,001–1,000,000 (20%), 1,000,001–2,000,000 (25%), 2,000,001–5,000,000 (30%), and over 5,000,001 (35%). Employees may also make social security contributions (typically 5% up to a capped base).

The 2024 change to foreign-income remittance

As mentioned earlier, from 1 January 2024, residents who bring foreign-sourced income into Thailand generally face Thai PIT on those remittances (the old strategy of parking income abroad and remitting it in a later year to avoid Thai tax no longer applies). In 2025, authorities floated a draft relief concept to exempt foreign income remitted within the same tax year or the following year, but note this has been discussed as policy-in-draft and should be confirmed at the time you file. In all cases, document your sources, dates earned, and dates remitted, and leverage double-tax treaty credits where available.

Practical planning points

- If you expect to become resident (≥180 days), map your cash-flow and remittance calendar early; careful timing and documentation can materially change your outcome.

- Expect normal Thai PIT treatment for employment, self-employment/business income, interest/dividends, and most capital gains (with specific exemptions outlined in the official expat tax guides). DTAs can provide foreign-tax credits to prevent double taxation.

“Wealth” taxes in Thailand—what actually applies?

Thailand does not levy a general annual net-worth tax on individuals. However, this might change as the Thai Government eyes on implementing a “Wealth” tax with asset tracking capabilities. This is not certain, and for now, expats should focus on:

- Inheritance tax: generally 5% for ascendants/descendants and 10% for others, above THB 100 million per benefactor (plus a separate gift tax regime with defined exemptions).

- Property-related levies: the Land & Building Tax (covered earlier in this article) is an annual charge based on use and assessed value rather than a wealth tax.

- Capital gains and investment income: taxed under PIT rules with specific nuances (for example, listed Thai securities may be treated differently from unlisted assets; always confirm current treatment when you file).

Bottom line for operators and professionals

- The business climate remains attractive—but structure matters (FBA limits, BOI scope, visa/work authorization).

- On the personal side, assume 0–35% PIT, remittance-based taxation of foreign income under the post-2024 framework, and no general wealth tax—but plan for inheritance/gift rules and annual property tax. Align Thai filings with your home-country obligations and use DTAs to reduce friction. For high earners and multi-jurisdiction portfolios, specialist cross-border tax advice is well worth it.

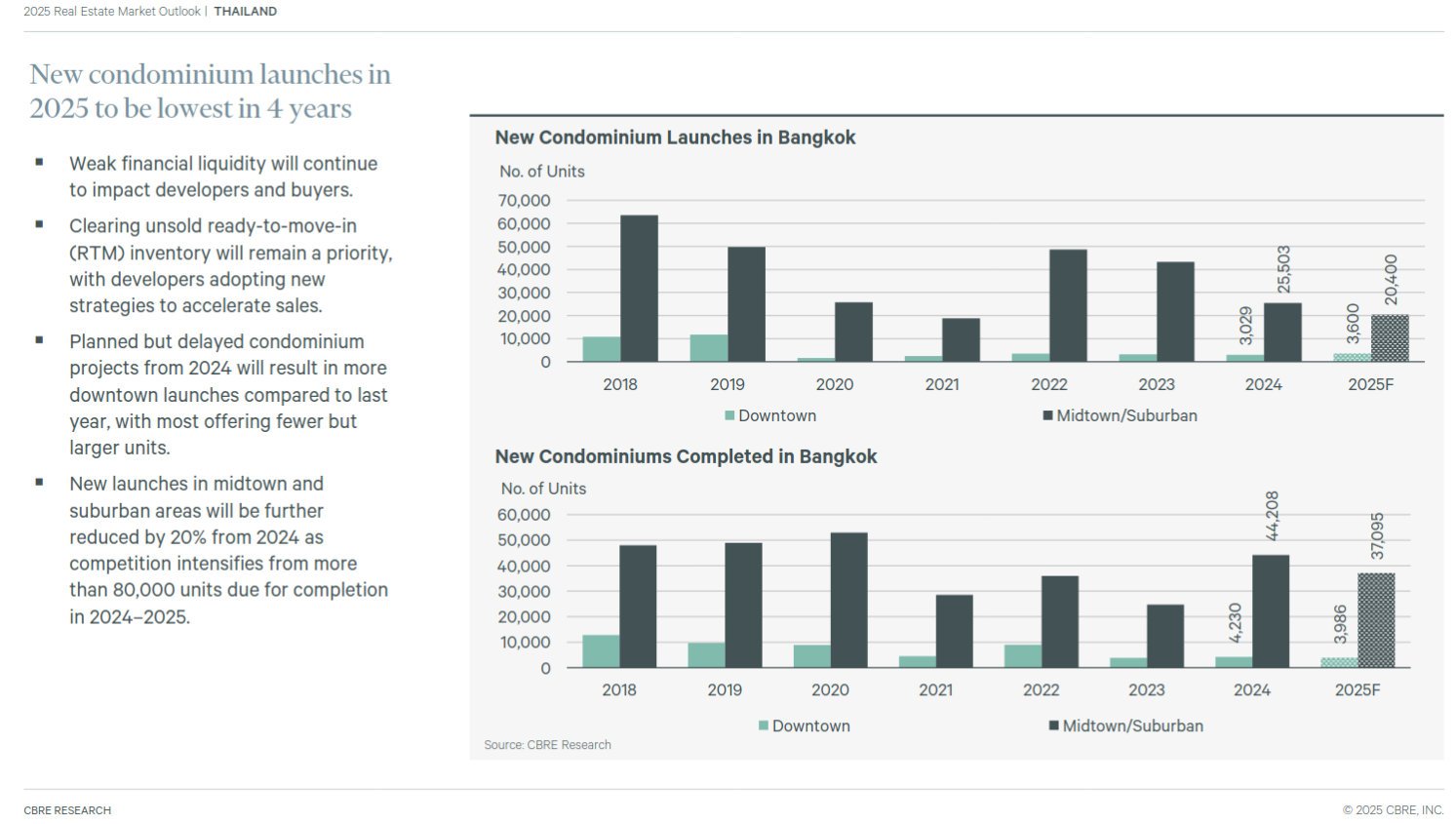

Market Trends in 2025: A Multi-Speed Recovery

Analysts describe 2025 as a year of “consolidation” in Thai residential property—particularly in greater Bangkok’s condo market—while hospitality and industrial/logistics show stronger momentum. Expect cautious new launches, selective price growth in prime downtown segments, and rents rising as some households prefer flexibility over purchases. Developer caution is evident: new condo launches in Bangkok fell to a 16-year low in Q2 2025 (≈373 units, –94% YoY), underscoring inventory overhang and cost pressures.

Demand composition continues to pivot across nationalities. In 2024, condo transfers to Myanmar nationals surged, making them the second-largest foreign buyer group after Chinese purchasers—illustrating Thailand’s role as a regional safety valve and lifestyle haven. That momentum carried into late 2024/early 2025 even as some traditional pools moderated.

The March 28, 2025 earthquake (epicenter in Myanmar) rattled market sentiment in Bangkok. An under-construction high-rise collapsed, authorities ordered safety reviews across thousands of buildings, and inspections later identified dozens with severe damage—all intensifying buyer scrutiny of engineering quality and developer reputation. The near-term effect: longer sell-through for generic high-rise stock, while newer, well-specified projects and low-rise options hold relatively firmer.

For context and the on-the-ground challenges—oversupply, safety anxieties, and a likely two-speed market—see Premier Possible’s report, “Bangkok’s Condo Market Faces Crisis Amid Oversupply and Quake.”

“Loopholes,” Alternatives, and Practical Protections

Stay within the law. The cleanest path for foreigners is a freehold condo within the building’s 49% foreign quota, funded from abroad with an FET form at transfer. For villas or land-based living, own the house, then secure the land via a registered 30-year lease (with clearly drafted, registered renewal rights) and—where helpful—superficies/usufruct to align control and ownership.

Don’t use nominee companies. Thai-majority shells set up to hold land for foreigners are illegal and risky. Only genuine operating structures (e.g., BOI-promoted projects) should ever own land—get specialist advice first.

Marriage ≠ land ownership. Purchases in a Thai spouse’s name often require a foreign spouse consent at the Land Office. If you contribute capital, protect it on paper via a registered lease, loan agreement, or superficies, and consider a prenuptial.

Paper and title protect you. Prefer Chanote titles; verify encumbrances, access, permits, and (for condos) foreign quota and unpaid fees. Use a bilingual, specific SPA that fixes fixtures, handover, defects, and tax/fee allocation.

Bottom line: A reputable Thai real estate lawyer is non-negotiable. They’ll test every link in the chain—title, building permits, juristic records, contract drafting, tax allocation, and registration logistics. This interview with a Thai Real Estate Lawyer provide answers to most asked questions related to property purchase questions by foreigners.

Buyer Profiles We’re Seeing

- Lifestyle end-users (executives, entrepreneurs, semi-retirees) targeting downtown freehold condos for convenience and a pied-à-terre in Asia.

- Yield hunters focusing on short-let suitable condos in tourist nodes or villa leases in resort markets, with professional management in place.

- Remote workers / creators leveraging DTV flexibility while renting long term and trialing neighborhoods before buying—reflecting the themes in Premier Possible’s digital nomads feature.

- HNWIs & global families pursuing LTR and similar long-stay visas, assessing education, healthcare, and regional diversification (see our Golden Visa effect analysis).

The Golden Visa, Thai-Style

Thailand’s Long-Term Resident (LTR) Visa functions as the country’s de-facto golden-visa: a 10-year (5+5), multiple-entry pathway aimed at Wealthy Global Citizens, Wealthy Pensioners, Work-from-Thailand and Highly-Skilled Professionals. It streamlines life on the ground—annual (not 90-day) reporting, fast-track processing, dependents allowed, and, where applicable, a digital work permit—and its 2025 refinements broadened eligibility, making the program more accessible to founders, specialists, and globally mobile families.

For location-independent earners who don’t need local employment, the Destination Thailand Visa (DTV) offers long stays with flexibility: a five-year, multiple-entry visa with stays of up to 180 days per entry (typically extendable once). It’s built for remote workers, creatives, and “soft-power” participants whose income is earned abroad—ideal for testing neighborhoods and lifestyles before committing to permanent structures.

Two other long-stay routes round out the picture. Retirement visas (Non-Immigrant O/O-A) serve the 50+ cohort with defined income/deposit requirements, while Thailand Privilege (formerly “Elite”) is a paid, 5–20-year residency-by-membership with immigration conveniences and lifestyle perks—useful for frequent, hassle-free stays rather than employment in Thailand.

Editorial tip: pick the visa first, then the asset. LTR suits executives and founders planning to work or invest in Thailand; DTV suits mobile professionals who want extended stays without local employment; Retirement fits end-users 50+; and Thailand Privilege suits frequent stayers seeking convenience. Aligning your visa with banking, tax, and property decisions up front prevents costly pivots later.

Outlook: Where Is Thailand’s Property Market Heading?

Expect a slow-grind recovery in condo sales, with prime downtown and ultra-prime boutique projects outperforming, while mid-market launches stay measured. Rents should remain firm where new supply is limited and inbound talent growth continues. Hospitality and logistics look set for outperformance, aided by tourism normalization and manufacturing diversification. For property buyers, that means:

- Condos: Pick location and building quality over headline discounts; check foreign quota, management quality, and exit liquidity.

- Villas: Treat lease structure as integral to value—registration quality, renewal options, and counterparties matter as much as the house itself.

- Taxes & holding: Budget conservatively for transfer costs and Land & Building Tax; align Thai and home-country tax advice early.

Conclusion — Quick Answers to the Big Question

Thailand’s appeal endures: high liveability at compelling value and a deep services ecosystem, now paired with visa pathways that fit different life stages. The practical rule is simple: choose your visa first, then your asset. The LTR (Thailand’s de-facto golden visa) suits founders and executives who intend to work or invest; the DTV offers long, flexible stays for location-independent professionals; retirement and Thailand Privilege complete the long-stay toolkit. Your immigration status touches banking, work authorization, and even how you time cross-border cash flows.

Be tax-aware from day one. Thailand uses progressive PIT up to 35% for residents (≥180 days), and since 2024 foreign-sourced income remitted into Thailand generally falls into scope—so remittance timing and documentation matter. There’s no general wealth tax, but inheritance/gift rules and Land & Building Tax do apply. Align Thai filings with your home country and use treaty relief where available.

On property, foreigners thrive by separating what’s clean from what needs structuring. A freehold condo within the 49% foreign quota, purchased with overseas funds and an FET form, gives the cleanest personal title. For villas and land-based living, pair house ownership with a registered long lease (and, where useful, superficies/usufruct)—and avoid nominee schemes. In 2025’s two-speed market—tempered by Bangkok’s quake-driven safety anxieties and lingering condo oversupply—value concentrates in well-engineered, well-managed assets; low-rise alternatives also look resilient as buyers scrutinize build quality and developer reputations.

Finally, price the full journey—transfer costs, ongoing taxes, and any rental obligations—and consider renting first to test neighborhoods. With a seasoned Thai real-estate lawyer, a cross-border tax adviser, and disciplined due diligence, you can capture what Thailand offers best: lifestyle, clarity of rights, and long-term value—with a confident exit path when the time comes.

If you enjoyed this guide on How to Buy Property in Thailand as a Foreigner in 2025, and Thailand isn’t final, you might as well also enjoy our guides on How to Buy Property in The Philippines as a Foreigner and How to Buy Property in Dubai as a Foreigner.