Whether your looking for a warm, tropical climate to settle in or you’ve met the love of your life and want to move to the Pacific archipelago, the Philippine real estate market can be a real headache for foreign nationals. The Philippine real estate market is loaded with opportunities—both business and residential wise—although most often affected by some laws and regulations prohibiting 100% foreign land ownership. The non-national property buyer has to go through a set of complex rules and requirements in order for a successful investment.

However, a prime opportunity the Philippines give foreign property investors through its Condominium Act, is foreign ownership of up to 40% of the titles in a condominium building. This opens opportunities for foreign investors to participate in the market, often at lower costs than land ownership properties. This is especially prevalent in urban areas such around Metro Manila and Cebu city where land prices are high.

In addition, the Philippines has adopted the Balikbayan Program that grants privileges to overseas Filipinos and former Philippine nationals. Through the program launched by the Philippine Government, they can for example own land. The Balikbayan Program can be a very useful for people with Filipino roots who want to start getting involved with Philippine real estate.

Legal Requirements and Restrictions for Foreigners Buying Property in the Philippines

There are several legal requirements and limitations that apply to property purchases by foreigners in the Philippines. It can be quite a maze navigating through, but these are general points that must be noted:

Land Ownership

A foreign individual or corporation, except for some really rare excepted cases, may not own land in the Philippines. It can however be acquired through inheritance if they were Filipino citizens by birth or through naturalization.

The easiest way for foreigners to own land is by marrying a Filipino national. However, the land must registered in the name of the Filipino spouse.

Additionally, a Philippine-registered company or corporation can be formed and acquire the land property. Also here, the majority stake holder/holders of the company must be Filipino nationals.

Condominium Ownership

Foreigners may own buildings and improvements on the land but not the land itself. But they can acquire condominium units or shares in condominium corporations wherein the land is owned by either the condominium corporation or co-owned by all unit owners.

Some suburbs follow the same ownership model as a condominium corporation. Here it is possible for foreign nationals to acquire single detached houses.

Foreign ownership of a condominium building cannot exceed 40% by law.

Acquisition of Land Through Lease or Loopholes

Some foreigners circumvent the prohibition of land ownership through legal loopholes; such as long-term leases of up to 50 years, renewable once for another 25 years, or buying property through a corporation where at least 60% of its shares must be Filipino-owned.

Special Investor’s Resident Visa

A Special Investor’s Resident Visa, with permanent residency and some privileges including land ownership, may be granted to foreigners who invest a considerable amount in the Philippines.

Balikbayan Privilege

Former Filipino citizens and the members of their immediate family are allowed to own land in the Philippines with some restrictions. For instance, they can only buy a maximum of 1,000 square meters for urban land and 1 hectare for rural land. However, a commercial property can be larger at 5,000 square meters of urban land and 3 hectares for rural land.

“Alienable And Disposable Lands”

The Philippines is working on reforming their Constitution of 1987. Among the changes in the reform is a Charter Change, allowing an estimated 14.2 million hectares of alienable and disposable lands to be open for 100% foreign ownership. If implemented, the change of law will not come without any forms of corresponding control. For example, agricultural land must remain agricultural.

Not surprisingly, this proposal has received a lot of criticism from locals stating that the Philippines is not for sale.

Foreigners who wish to buy any form for property in the Philippines have to navigate through complex maze of legal requirements and restrictions. It is therefore important for anyone planning to buy property in the Philippines to educate themselves on laws, regulations and do proper research before taking the step.

Navigating the Process of Purchasing a Property in the Philippines as a Non-Filipino

The Philippine Constitution sets limits on what foreigners can own and not, but there are exceptions and ways that foreign nationals can own land. Following that, you have to discover the best property that matches your requirements and budget. This may involve working with renowned real estate agents specializing in properties for international buyers. They are the ones who can give you essential information on the local market and take you through the required documentations and legal requirements. Many notable upscale real estate developers in the Philippines has their own international department such as Ayala Land International Sales and SMDC International Team. We also have our own section for Manila on our listing platform.

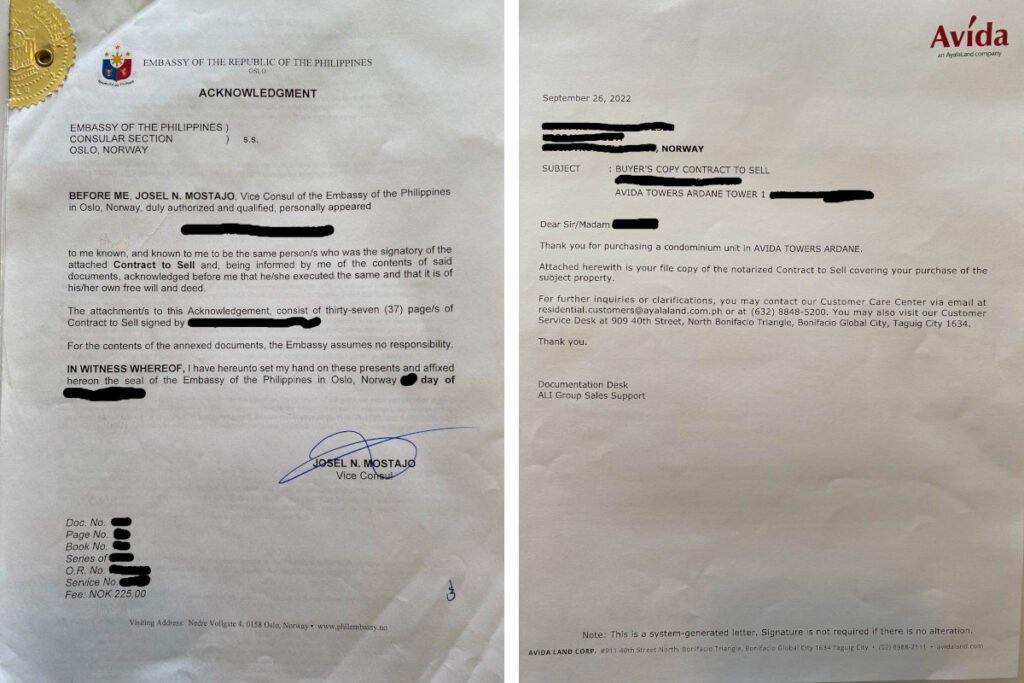

Once the ideal property has been identified, the real job starts—checking on the title, carrying out due diligence and working on all the documentation related to the the transaction. For a much more hassle free process, engaging a competent, local lawyer on Property Law comes at an extra cost but could be well worth it. Only he/she would be able to handle the niceties of Philippine law in regard to the property being acquired representing you protecting your interests. Remember that the agent represent the developer/seller earning commissions on each sale.

Consequently, purchasing property in the Philippines by a non-Filipino is not without risk. It will not only need patience and proper preparations, but also the capability of maneuvering through its peculiar legal frame. It is only with the right set of professionals at your side of the table that you could confidently set a foot in the market and purchase your share.

Financing Options for Foreigners Investing in Philippine Real Estate

There are viable solutions available that can help you make your property dreams a reality in the Philippines.

Developers offer various payment plans for their clients. Some request the entire balance to be paid right after the reservation, while some offer very generous downpayment plans for their buyers. One such downpayment plan can be a 60 month amortization plan where 20% of the contract sum shall be paid. After 60 months the remaining 80% balance shall be paid either in cash or through bank financing. This is a 5-year period with low monthly amortizations where you as a buyer have plenty of time to plan ahead. Just ask your agent if they offer DP plans and ask to see the Computation Sheet.

Foreigners can also apply for a mortgage with local Philippine banks. While requirements are a bit different from the standard Filipino-citizen mortgage, many banks have programs for non-Filipino buyers. The process is basically the same as any application: submitting documents proving one’s income, assets, and credit card history. For non-nationals, having an ACR Card makes the application process a lot easier. It is basically a temporary residency card granted to individuals staying longer than 59 days in the Philippines. It grants you the right to stay in the country for a long period of time. Being married to a Philippine national also eases up the process quite a bit.

Alternative financing routes can also be considered aside from traditional mortgages. They could be in the form of joint ventures with local Filipino partners, offshore banking relationships, or even all-cash acquisitions. Each one has multiple factors that need to be carefully weighed, so it is an investment decision that requires a lot of research and consultation beforehand. Especially when you are on non-domestic territory.

Maximizing Returns: Rental Income and Capital Appreciation

Foreign investors can also gain exceptionally good returns on investment from Philippine real estate. In the recent years, it is one of places with the highest return of investments(ROI) for both rental income and capital appreciation on property.

This is the effect of a fast-growing economy and an expanding middle class. It possesses a booming rental market where the demand could be used by a foreign investor to create a constant and reliable rental income. And the easiest type of property to find tenants for are condo units—That legally can be owned by foreign nationals—Often including pools, gyms and staffed reception areas. Wise choices of location and property types will help an investor attract long-term tenants in high demand situations and secure a continuous passive income.

The property market within the country has adequately posted impressive capital appreciation over the years, way surpassing most other available options for domestic investment. With the economy having a positive trajectory of growth and urbanization continuing speeding up, your property values are bound to increase, enabling one to reap large capital gains upon selling.

From rental income to capital appreciation, foreign investors can come up with exceptional overall returns from their Philippine real estate portfolio. With the right advice and local market insight, it’s a vibrant market full of opportunities awaiting you.

Conclusion: Key Considerations for a Successful Philippines Property Investment

Investing in Philippine property is very doable for foreigners, but it hinges on several key factors:

Legal and Regulatory Landscape

Understand foreign ownership restrictions and regulations governing property acquisition. Seek legal advice to navigate complexities. Remember that a local lawyer is working for you, the agent is working for the seller and receives commissions.

Location Analysis

Conduct thorough research on location dynamics. Urban areas like Metro Manila offer high rental yields but come with higher property prices. Provinces may offer lower costs but require careful assessment of market demand and lack of infrastructure.

Market Trends and Demand

Be aware of the trends in the market and the drivers of demand. These include urbanization, construction of infrastructure and demographic changes, all of which have effects on property values and their rental potentials. If a new road is being built in the Philippines, new settlements around pop up really quick.

Financial Feasibility

The cost of investment include taxes, fees, and maintenance costs. Assess potential return on investment through rentals or property appreciation. Consider your financing options and exchange rate risks—if investing as a foreigner.

Infrastructure and Amenities

Ensure that your property it is located close to transportation hubs, schools, hospitals and retail centers. Any property that has easy and fast access to all the required amenities and infrastructure tends to attract tenants and appreciate in value. If you plan to keep the residential property as your own home, being at close proximity to a hospital in the Philippines could be the matter of life and death. It is common for ambulances and other emergency personnel to be stuck in traffic jams, especially in highly urbanized areas.

Risk Management

If you plan to purchase several properties, you should reduce your risks by diversifying your investments in different types of properties and locations. Consider factors like natural disasters, changes in economic conditions and political stability in your investment decisions.

There are great regional differences in the Philippines. Typhoons in north, earthquakes, insurgents in south, volcanoes, landslides in the mountains, etc.

Long-term Strategy

Make a plan for your long-term investment goals. Consider appreciation potential in property value over time and strategize for exit when appropriate. Rapid urbanization combined with an ever increasing middle-class continues to drive the rental prices up. A condo unit purchased now will yield you great rental income in 10 years. Or you can just live there by yourself and call it your new home.

Foreign buyers should know how to maximize the opportunities and minimize risks associated with buying Philippine property. Local experts’ advice and real estate professionals’ help will gain valuable insights and advices on how to successfully obtain a property in the Philippines as a foreigner with as little hassle as possible.

Next guide in this series is How to Buy Property in Dubai as a Foreigner.