Understanding the Apartment Rental Business Model as a Newbie

For most people looking to create a passive, portable income stream, the apartment rental business could be a very lucrative and secure investment. If done correctly.

At its most basic level, this business model revolves around the acquisition of apartments & condominium units for rent and unit management. Subsequently drawing rent from tenants.

One of the main advantages of a condominium/apartment rental business is the likelihood of stable, steady cash flow—Compared to many other investment options. Rental properties can provide one with a very reliable stream of monthly rental income. If managed really well, it can help underpin or, in some cases, replace traditional employment earnings. This makes it attractive option to people eyeing the security and independence of their finances, including financial independence. Imagine just laying on the beach watching the bank account grow being your own boss.

In most cases, this business model provides long-term appreciation possibilities for an invested property. The wise investor buy properties at the right time and then hold on, looking to see the natural growth in property values over time. They will hold on while the real estate market continues to fluctuate. Eventually cashing in on the pot of gold in the end of rainbow.

Basically, a successful apartment rental businesses require—In addition to right financing—a solid underpinning in property management, tenant screening and maintenance. A good landlord needs to be knowledgeable about relevant laws and regulations governing the business, ensure that all operations are in compliance with local legislation, and be able to keep his units in good condition and match them up with good tenants.

a solid underpinning in property management, tenant screening and maintenance. A good landlord needs to be knowledgeable about relevant laws and regulations governing the business, ensure that all operations are in compliance with local legislation, and be able to keep his units in good condition and match them up with good tenants.

Adopting an apartment rental model, investors will have a chance of great financial gain and long-term sustainable investment portfolios. Having acquired the proper knowledge, resources, and strategic approach, an apartment rental business is a good way of achieving financial freedom and security.

1. Determining Your Target Market and Rental Property Location

Getting into the right target market and property location is crucial to the long-term ability of any rental investment. Proper research into your potential target rental market will help in making informed decisions that ensure maximum returns with minimum risk.

While evaluating a target rental market, some major demographic indicators include size, age distribution, household income, and employability rates. This will help you underline areas that have the most demand for rentals from your ideal tenant profile. Additionally, research the real estate local trends, such as the average rents, vacancy ratio, and competition from other landlords.

The location of your rental property is as key as the very market itself. It should have proximity to desirable amenities, transportation centers, and employment hubs. Factors that will drastically effect the property desirability and long-term value. This is where your real homework begins: scouting the potential neighborhoods, evaluating local school systems, job opportunities and ensuring the area aligns with the lifestyle preferences of your target renter.

Thorough market research is the key factor separating wins from failures. It shall arm you with the necessary knowledge in making strategic decisions. You will position yourself better in the market and maximize your opportunities for long-term profitability.

2. Financing Your New Business as a Rental Property Owner

When it comes to starting and growing a property rental business, securing the right financing is crucial. The world of rental property financing can, perhaps, feel a bit overwhelming to both first-time investors and also seasoned real estate moguls.

One of the major sources of financing is an Investment Property Loan. These loans come specifically to meet the requirements of the rental property owner with competitive interest rates and flexible terms of repayment. Whether traditional mortgages or commercial loans, a good deal of financing should be one of your highest priorities on the list.

In addition to Investment Property Loans, rental property owners have other financing methods available such as Hard Money Lenders and Crowdfunding. Through these channels, one can access capital that is otherwise difficult to come by when trying to use traditional banking sources—Last resort financing especially for those who have poor or thin credit scores, or for those who are investing in unique scenarios.

It’s very important while computing the start-up costs for your apartment rental business that not only the purchase price, but also the necessary renovations and legal proceedings followed by ongoing operation expenses are taken into consideration. Careful budget-planning, along with the right financing, may set your start-up up for long-term success.

Remember that the key to financing is not just picking from the various options available. But rather understanding their requirements and terms, choosing the one you’ll most likely profit from with regards to your investment goals and financial capacity.

3. Renovating for Higher Rent And Better Appeal

If you’re looking to build wealth through real estate, investing in rental apartments can be a highly profitable venture. The thing is, the key to large gains does not lie in the mere purchase, but partially also strategic renovations.

You should search for undervalued properties that you may cost-efficiently improve into a more modern living space and get them a higher-paying tenant base. Proper property investment, coupled with intelligent upgrading, will increase rental income and property value very appreciably.

Renovations are quite crucial in rental flats. Simple low-cost renovations like new paint, appliances and new fixtures, can provide an increase in rent. Larger renovation projects—Such as kitchen and bathroom renovations—Will cost a lot more, but certainly make your rentals more attractive and can be quite rewarding. Carefully plan your renovations to influence the maximum return on your investment. And never do plumbing or electrical work yourself. Insurance companies will refuse to insure your property if you lack license to perform such works.

Remember, real estate investments demand diligence in research and planning. The right properties, proper investment, and strategic renovation work can build you a fortune with passive income streams running constantly for years to come.

4. Establishing Effective Rental Policies and Procedures

Any serious landlord should have a clearly spelled-out set of rental policies and procedures. Operating with a such layout add to the chances for a stable and successful business. It also provides additional protection to your investment and ensures a positive and serious experience between you and your tenants. We’ll have a closer look at the major elements of effective rental policies and procedures that every landlord should implement:

Proper Tenant Screening

This forms the base of your rental policies. It should include credit checks, employment verification, and reference checks to guarantee that you’re dealing with responsible and reliable tenants. This will set out very clear criterias for tenant eligibility for your rentals, hence minimizes occurrences of payment defaults and property damage.

Rental Agreement Templates

Basic and Comprehensive rental agreement templates are designed to define the rights of a landlord and responsibilities of a tenant. This document dictates details, including the amount of rent, due dates, security deposits, and rules about property use, their repairs, and termination. These standardized templates allow you to manage your entire rental portfolio consistently and clearly.

There are tons of free resources available online that you can take advantage of including Rental Agreement Templates.

Rent Collection Methods

Make your rent collection easy for your tenants. You can do this by giving them an online payment option, automatic bank account withdrawal and mobile payment apps that will make it easy for tenants to pay rent. Be explicit about collection policies on late fees and grace periods to set expectations for timely payments. But you should be generous on everything else. Be a good landlord.

Property Management Systems

Invest in a respectable property management system to bring tremendous efficiency into your rental operations. Many of these platforms include tenant tracking, maintenance requests and financial reporting. This will keep your operations organized and thus in a position to make decisions based on data. Automate your administrative tasks to free time for the other critical aspects of your rental business.

Having clear-cut, strongly implemented policies and procedures in your rentals, will make your investment much more professional and seamless, hence providing a solid layout to follow for both you and the tenant. It will not only help in safeguarding your investment but also nurture a healthy landlord-tenancy relationship. A key to long-lasting success in the rental market anywhere.

5. Marketing and Advertising Your Rental Properties

Effective Marketing—The key to full occupancy and consistent cash flow. Advertise your rentals most effectively to give maximum exposure toward a larger base of prospective tenants across a wide array of digital and traditional channels.

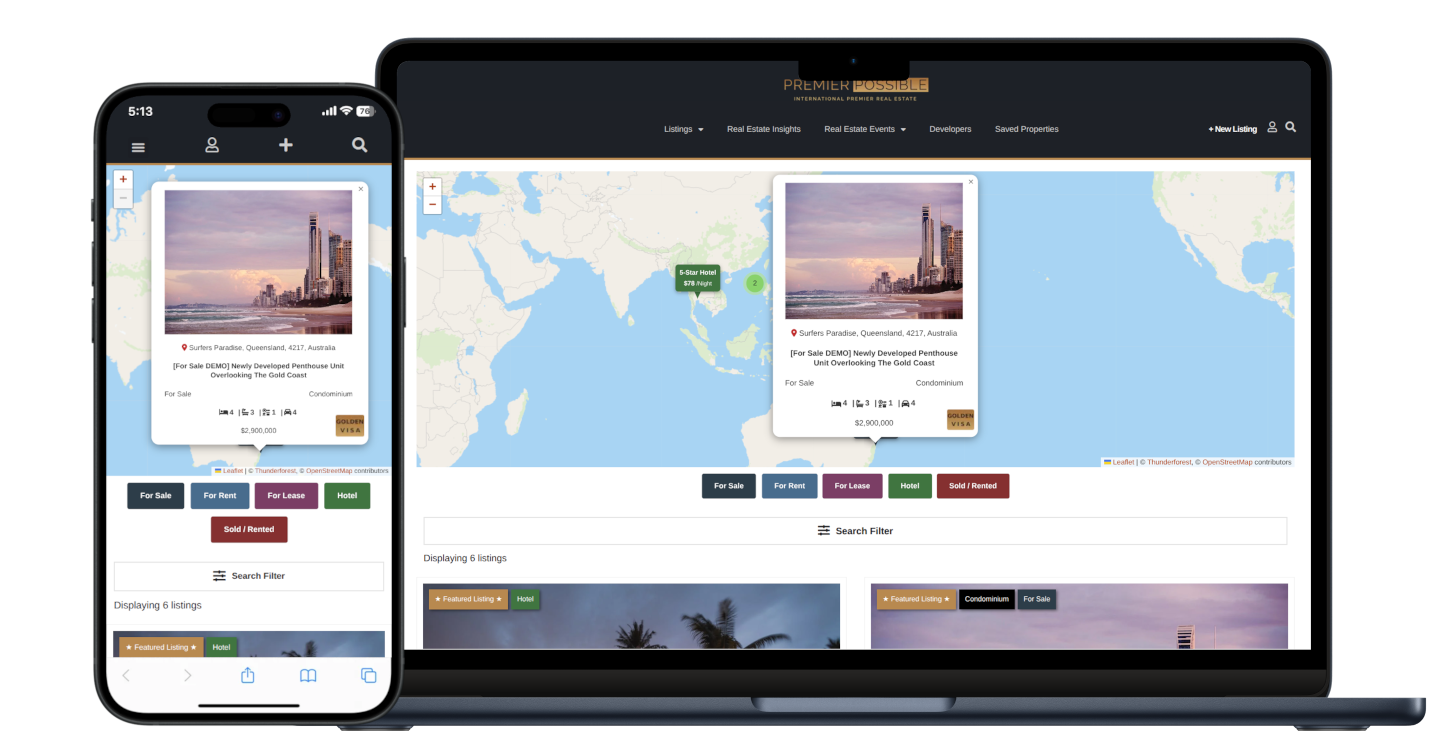

Try to keep an active, descriptive, and graphic presence on popular rental listing websites. Ensure visible listings that include quality imagery, broad descriptions, and competitive pricing for your units. If your property is a bit upscale, you can for example post it on our platform for free. Supplement this with a strong social media strategy utilizing channels like Facebook and Instagram to build your brand and engage with potential renters in your target group.

Besides digital, don’t underestimate the power of offline marketing. Consider investing in eye-catching signage for your properties, distributing flyers within the local community, and networking with real estate agents and property management companies. A cohesive approach to branding is one that covers all your marketing touchpoints, helps cement your properties as marketable rentals, and drives new tenant demand.

6. Managing Tenant Relations and Property Maintenance

Effective property management is most definitely the tight act between good relations with tenants and professional timely maintenance. Open communication with tenants on their needs regarding maintenance will undoubtedly prove positive in tenant retention and positive rental experiences for all parties.

The foundation of managing this relationship is an understanding of landlord-tenant laws in your jurisdiction. Familiarize yourself with your local regulations covering security deposits, rent increases, maintenance responsibilities, and the rights of the tenant. Proactive adherence to such guidelines will only give you and your brand a good reputation in the long-term. Transparent and lawful practices is the way to go. You don’t want to wake up only to find yourself publicly shamed on Facebook in some rental group.

Regularly scheduled visits or e-mail follow-ups will keep you from finding issues that could spiral out of control rapidly. You can be certain that quick attention to maintenance requests and a good, structured preventive maintenance program will have them living comfortably in a well-maintained setting. Your monetized return on this investment will not only come back in the form of very satisfied and long-term tenancy, but also increased property value.

7. Scaling Your Apartment/Condo Rental Business

As an apartment/condo rental business owner, the urge to grow and increase your portfolio should be unabated. In actual sense, any increase in the number of units directly adds to the cash flow, higher profits, and long-term built-up wealth. However, scaling of a rental business requires particular planning and strategic execution.

Diversify your rental income streams, automate key operations tasks, and, importantly, be thoughtful about growing your portfolio—which should secure you a future of sustainable and profitable growth. Innovate ways in which additional revenue can be realized could be, for example, adding premium amenities or vacation rentals. Advantageous technology will save time by automating tenant screening, rent collection, and maintenance requests. Freeing more of your valuable time to focus it on non-automatized tasks. Be disciplined in the acquisition of new properties, paving a way into locations and assets that match your investing goals.

If it ever happens that your business reaches a substantial amount of properties in its portfolio, consider 3rd party property management firms to manage your units. These firms charge a bit, but are professional in their trade and will free even more of your time. 3rd party property management firms are especially lucrative if having full-time employees are bit too much. They are also a lot easier to swap out if things aren’t working out.

Scaling of an apartment rental business may seem to be tried by fire and water. With the right mindset and approach, opportunities never cease to exist. Adopt a mindset of calculated risk-taking and customer-centric attitudes to watch your rental empire grow to new heights.

8. Optimizing Financial Management and Tax Strategies

As a savvy rental property owner, you want to be on top of the game concerning financial management and tax strategies. Proper accounting and tax planning can make all the difference in your bottom line. Think about the profit margin here.

This includes knowing about landlord tax deductions. There are a whole mess of write-offs you can take advantage of. From the interest on your mortgage and fees paid to property management to scores of other deductions that might help offset your rental income. Make sure you’re maximizing those deductions to keep more of what you earn.

Equally important is to state the amount of income you are earning from the rentals accurately. Keep an accurate record and work with a certified public accountant to ensure everything conforms to taxes. This will save you a lot of headaches from punitive penalties down the line.

You also want to be continually reevaluating your property’s valuation and managing your cash flow. By doing so, you can make proper decisions regarding investment, upgrading, and long-term financial planning. Having the right strategies in place will help optimize your rental property for profitability and lasting wealth.

Start Building Your Rental Business Today And be Your Own Boss

In conclusion, succeeding in the rental market requires a lot more than just listing your property on classified ad sites and cashing in on the tenants.

It requires a lot from you as a property owner and manager. From the process of finding the perfect unit in the right spot, acquiring financing to screening tenants and maintaining your apartments/condos; everything should be thoroughly researched and carefully executed. All in a professional manner.

Follow local rules and regulations as this is the way to go in the long run. Don’t take shortcuts as these rarely pay off in a 10-30 year span.

Being on top of financial management and tax strategies could be your key in the bottom line. Read your local tax regulations carefully and try to catch all the small details. Proper accounting and tax planning can mean a world of difference in maximizing profit.

Comments (2)

A really good introduction to the subject. Any idea however how easy or difficult it is to obtain a business licence to operate as a landlord in NJ?

New Jersey Department of Community Affairs, Division of Codes and Standards, Landlord-Tenant Information Service require you to fill out this form to legally register as a Landlord: https://www.nj.gov/dca/divisions/codes/forms/pdf_lti/landlord_regs.pdf